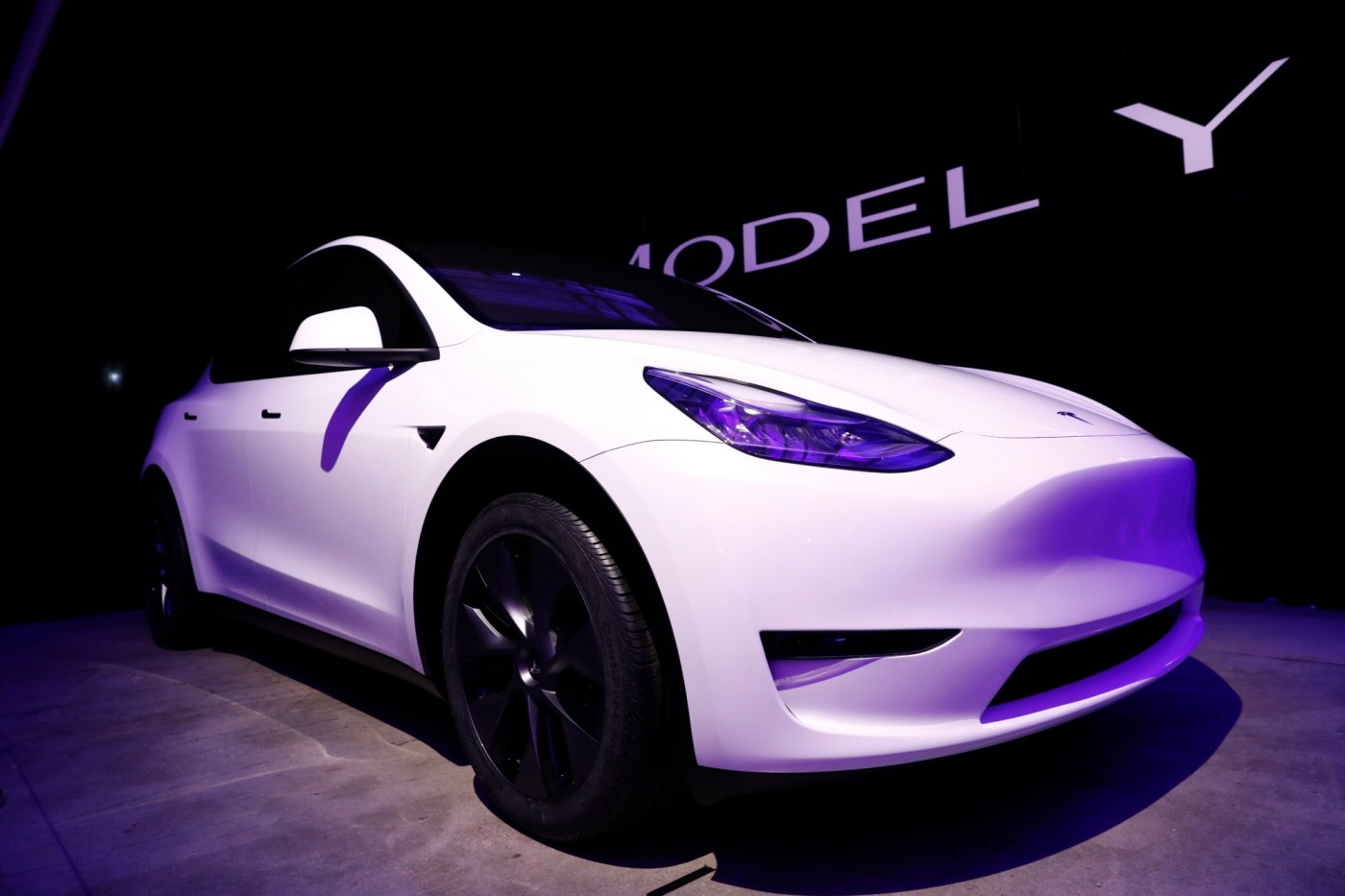

AGF Management Ltd. Acquires 5,573 Shares of Tesla, Inc. $TSLA

- by americanbankingnews

- Feb 02, 2026

- 0 Comments

- 0 Likes Flag 0 Of 5

Share on Stocktwits

AGF Management Ltd. lifted its stake in Tesla, Inc. (NASDAQ:TSLA – Free Report) by 1.0% in the 3rd quarter, HoldingsChannel reports. The firm owned 550,663 shares of the electric vehicle producer’s stock after acquiring an additional 5,573 shares during the period. Tesla makes up 1.1% of AGF Management Ltd.’s portfolio, making the stock its 21st largest holding. AGF Management Ltd.’s holdings in Tesla were worth $244,891,000 as of its most recent SEC filing.

Get Tesla alerts:

Other institutional investors and hedge funds also recently bought and sold shares of the company. Manning & Napier Advisors LLC bought a new position in shares of Tesla in the third quarter worth approximately $29,000. Westend Capital Management LLC bought a new position in Tesla in the 3rd quarter worth $32,000. Chapman Financial Group LLC bought a new position in Tesla in the 2nd quarter worth $26,000. LGT Financial Advisors LLC purchased a new stake in Tesla in the 2nd quarter worth $29,000. Finally, CoreFirst Bank & Trust bought a new stake in Tesla during the second quarter valued at about $30,000. 66.20% of the stock is currently owned by hedge funds and other institutional investors.

Tesla Trading Up 3.3%

Shares of NASDAQ TSLA opened at $430.41 on Monday. The company has a quick ratio of 1.77, a current ratio of 2.16 and a debt-to-equity ratio of 0.08. The business has a fifty day simple moving average of $447.69 and a two-hundred day simple moving average of $408.78. The firm has a market cap of $1.62 trillion, a PE ratio of 398.53, a price-to-earnings-growth ratio of 7.34 and a beta of 1.86. Tesla, Inc. has a twelve month low of $214.25 and a twelve month high of $498.83.

Tesla (NASDAQ:TSLA – Get Free Report) last issued its earnings results on Wednesday, January 28th. The electric vehicle producer reported $0.50 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.45 by $0.05. Tesla had a net margin of 4.00% and a return on equity of 4.86%. The company had revenue of $24.90 billion for the quarter, compared to analysts’ expectations of $24.75 billion. During the same period in the prior year, the business earned $0.73 EPS. The firm’s quarterly revenue was down 3.1% on a year-over-year basis. Analysts expect that Tesla, Inc. will post 2.56 earnings per share for the current fiscal year.

Insider Transactions at Tesla

In other news, Director Kimbal Musk sold 56,820 shares of the business’s stock in a transaction on Tuesday, December 9th. The stock was sold at an average price of $450.66, for a total value of $25,606,501.20. Following the completion of the transaction, the director directly owned 1,391,615 shares of the company’s stock, valued at approximately $627,145,215.90. The trade was a 3.92% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. Also, Director James R. Murdoch sold 60,000 shares of the stock in a transaction dated Friday, January 2nd. The shares were sold at an average price of $445.40, for a total transaction of $26,724,000.00. Following the sale, the director directly owned 577,031 shares of the company’s stock, valued at approximately $257,009,607.40. The trade was a 9.42% decrease in their ownership of the stock. Additional details regarding this sale are available in the official SEC disclosure. In the last three months, insiders sold 119,457 shares of company stock valued at $53,501,145. Corporate insiders own 19.90% of the company’s stock.

Analysts Set New Price Targets

Several analysts recently issued reports on the company. Canaccord Genuity Group set a $520.00 target price on Tesla in a research report on Thursday. Cantor Fitzgerald reiterated an “overweight” rating and issued a $510.00 price target on shares of Tesla in a report on Thursday. Stifel Nicolaus set a $508.00 price objective on Tesla in a research note on Thursday. Roth Mkm set a $505.00 price objective on shares of Tesla and gave the stock a “buy” rating in a research note on Thursday, October 23rd. Finally, Benchmark reiterated a “buy” rating on shares of Tesla in a report on Thursday, October 23rd. Seventeen research analysts have rated the stock with a Buy rating, fourteen have assigned a Hold rating and eight have issued a Sell rating to the company. Based on data from MarketBeat, the company has an average rating of “Hold” and a consensus target price of $409.58.

Please first to comment

Related Post

Stay Connected

Tweets by elonmuskTo get the latest tweets please make sure you are logged in on X on this browser.

Energy

Energy