Tesla, Inc. $TSLA Position Increased by Jones Financial Companies Lllp

- by americanbankingnews

- Feb 02, 2026

- 0 Comments

- 0 Likes Flag 0 Of 5

Negative Sentiment:

First annual revenue decline and softer vehicle deliveries raise near‑term execution concerns — investors worry Optimus/robotaxi revenue is far out and that margins could be pressured during the transition.

Negative Sentiment:

Notable bearish analyst moves (e.g., JPMorgan cut to underweight with a $145 target) increase downside headline risk and may cap rallies until clarity on capex pacing and robot/robotaxi ramps arrives.

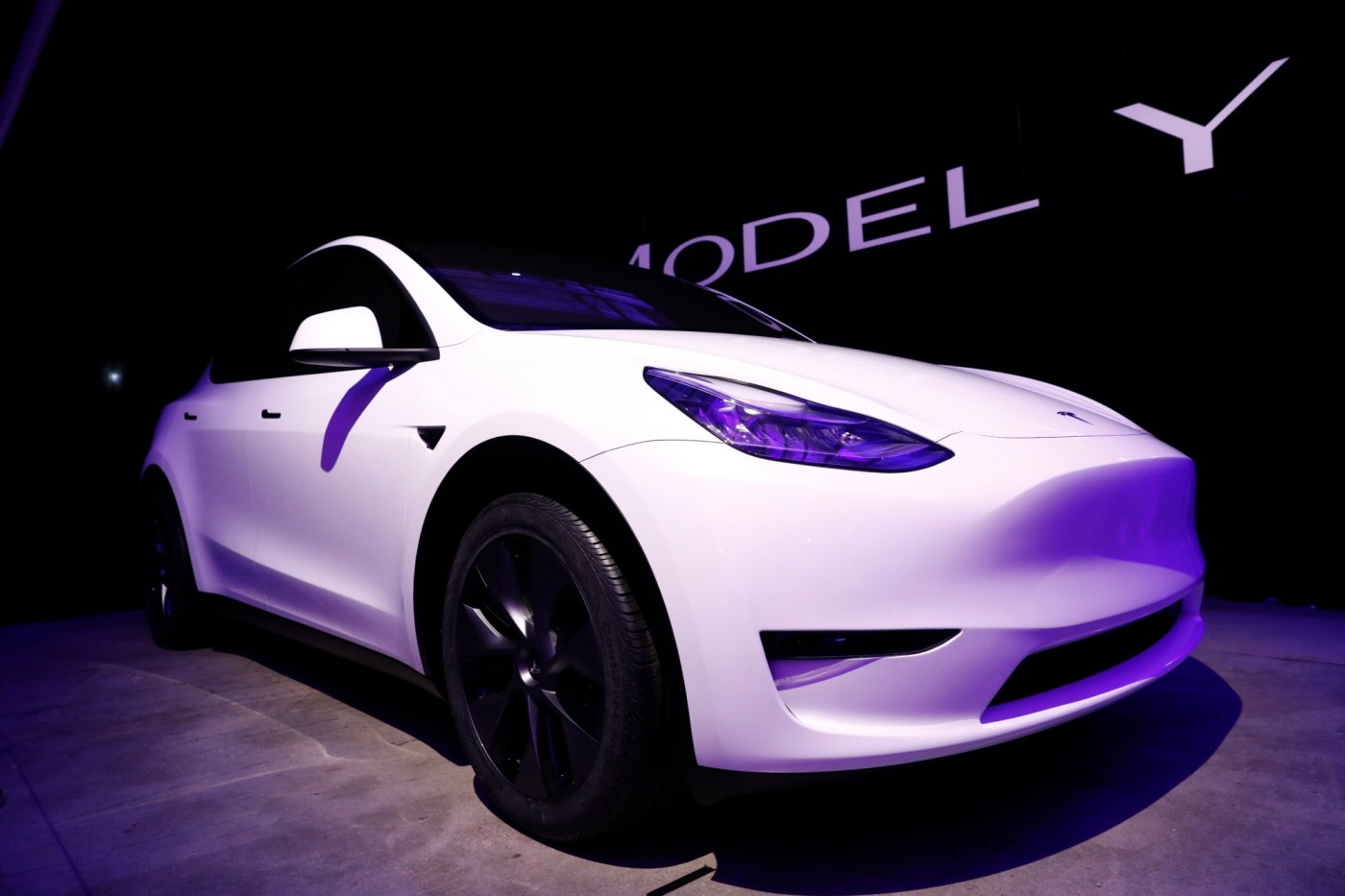

Tesla Price Performance

Shares of NASDAQ:TSLA opened at $430.41 on Monday. The company has a market capitalization of $1.62 trillion, a PE ratio of 398.53, a price-to-earnings-growth ratio of 7.34 and a beta of 1.86. The company has a debt-to-equity ratio of 0.08, a quick ratio of 1.77 and a current ratio of 2.16. The stock has a fifty day moving average of $447.69 and a 200-day moving average of $408.78. Tesla, Inc. has a one year low of $214.25 and a one year high of $498.83.

Tesla (NASDAQ:TSLA – Get Free Report) last announced its earnings results on Wednesday, January 28th. The electric vehicle producer reported $0.50 EPS for the quarter, beating the consensus estimate of $0.45 by $0.05. Tesla had a return on equity of 4.86% and a net margin of 4.00%.The business had revenue of $24.90 billion during the quarter, compared to the consensus estimate of $24.75 billion. During the same period in the prior year, the business posted $0.73 earnings per share. Tesla’s revenue was down 3.1% compared to the same quarter last year. As a group, equities analysts anticipate that Tesla, Inc. will post 2.56 EPS for the current fiscal year.

Analyst Upgrades and Downgrades

A number of equities research analysts recently weighed in on TSLA shares. BNP Paribas Exane upped their price objective on shares of Tesla from $307.00 to $313.00 in a report on Monday, December 1st. Wells Fargo & Company reduced their price target on shares of Tesla from $130.00 to $125.00 and set an “underweight” rating for the company in a research note on Thursday. Stifel Nicolaus set a $508.00 price objective on shares of Tesla in a research note on Thursday. President Capital cut their target price on Tesla from $517.00 to $500.00 and set a “buy” rating for the company in a research report on Friday. Finally, JPMorgan Chase & Co. lowered their price target on Tesla from $150.00 to $145.00 and set an “underweight” rating on the stock in a research report on Friday. Seventeen equities research analysts have rated the stock with a Buy rating, fourteen have issued a Hold rating and eight have given a Sell rating to the company’s stock. According to data from MarketBeat.com, the stock presently has a consensus rating of “Hold” and a consensus target price of $409.58.

Please first to comment

Related Post

Stay Connected

Tweets by elonmuskTo get the latest tweets please make sure you are logged in on X on this browser.

Energy

Energy