How Project Kuiper Could Reshape Amazon's Future, Tap Into $40 Billion Demand

- by Benzinga

- Jul 10, 2025

- 0 Comments

- 0 Likes Flag 0 Of 5

Also Read: Why Amazon Lags Its Peers In 2025

In his report, the analyst refreshed his views on launch costs and near-term expense impact from network build, the Project Kuiper business, potential synergies with Amazon, competitive landscape, revenue potential, and potential subscriber breakeven level assuming a 5-year satellite replacement cycle.

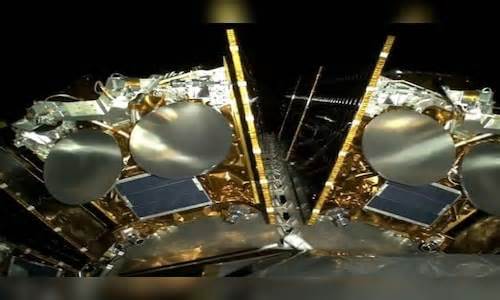

Amazon’s FCC license calls for 1,618 satellites to be deployed by July 2026, though Post noted an extension is possible given launch delays. Amazon completed the first two launches with 54 satellites in the second quarter of 2025, and the analyst expects an accelerated launch rate in the second half of 2025 (3 launches in the third quarter) and 2026.

He estimated that Amazon could spend $23 billion to build its entire constellation, using various public industry estimates, excluding consumer equipment costs.

In the near term, Post estimated over $600 million in constellation expense in the second quarter, ramping to ~$800 million in the third quarter and then growing to $1.1 billion in the fourth quarter of 2025 (before capitalization starts in the first quarter of 2026).

Amazon’s website indicates that consumer availability could begin in the fourth quarter, but a delay seems possible, the analyst said. He also had a scenario where capitalization starts later, in the third quarter of 2026.

He noted that 2.6 billion people globally lack broadband internet access, and BCG sees a $40 billion 2030 revenue potential for the global satellite communications service market.

Based on Post’s market assumptions, and assuming Amazon has just a 30% consumer share (Starlink already has 6 million subscribers), the analyst noted a $7.1 billion 2032 revenue potential for Amazon.

He also expects Kuiper to have synergies with Amazon’s logistics network, and the project to generate additional revenues from AWS’s enterprise and government customers. Post noted a compelling opportunity and potentially strong long-term margins given high start-up costs.

Post projected fiscal 2025 sales of $696.81 billion and EPS of $6.07.

AMZN Price Action: Amazon.com shares were up 0.09% at $222.75 at the time of publication Thursday, according to Benzinga Pro.

Read Next:

Please first to comment

Related Post

Stay Connected

Tweets by elonmuskTo get the latest tweets please make sure you are logged in on X on this browser.

Energy

Energy