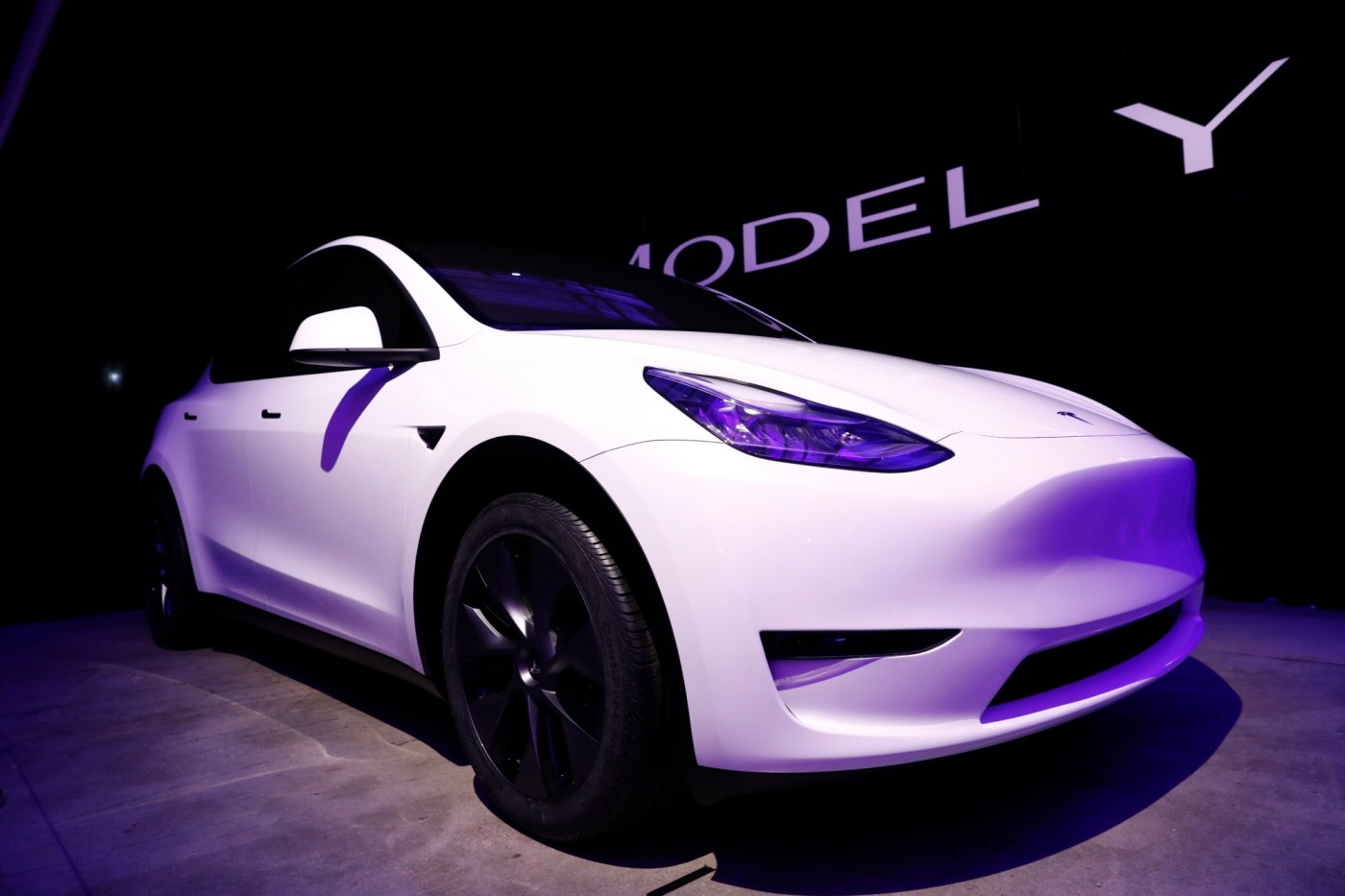

Tesla (NASDAQ:TSLA) Trading 3.3% Higher After Analyst Upgrade

- by americanbankingnews

- Jan 30, 2026

- 0 Comments

- 0 Likes Flag 0 Of 5

Image from MarketBeat Media, LLC.

Key Points

Shares rose 3.3% after UBS raised its price target from $307 to $352 despite maintaining a sell rating; TSLA traded as high as $439.88 on a volume of ~82.2M shares, +29% vs. average.

Analyst opinions are mixed — 17 Buys, 14 Holds and 8 Sells, with a MarketBeat consensus of "Hold" and an average target of $409.58, while some firms (Canaccord $551; Stifel $508) have much higher targets.

Tesla slightly beat Q4 estimates (EPS $0.50 vs. $0.45; revenue $24.9B) but revenue was down 3.1% YoY; recent moves — a $2B investment in xAI, SpaceX merger chatter, and a planned >$20B 2026 capex plus ending Model S/X production — boost "physical AI" upside but raise short‑term execution and cash‑burn risk. Tesla Kills Legacy Models: Analyst Response Is Meh

Hedge funds have recently made changes to their positions in the business. Networth Advisors LLC purchased a new stake in Tesla in the 4th quarter worth $26,000. Davidson Capital Management Inc. raised its stake in Tesla by 79.4% during the 4th quarter. Davidson Capital Management Inc. now owns 61 shares of the electric vehicle producer's stock valued at $27,000 after purchasing an additional 27 shares during the last quarter. Turning Point Benefit Group Inc. bought a new position in Tesla in the 3rd quarter valued at $30,000. Manning & Napier Advisors LLC bought a new position in shares of Tesla in the 3rd quarter valued at about $29,000. Finally, Prism Advisors Inc. bought a new position in Tesla in the 4th quarter valued at about $30,000. Institutional investors own 66.20% of the company's stock.

Tesla Trading Up 3.3%

The firm has a 50-day moving average of $446.91 and a 200 day moving average of $406.71. The company has a market cap of $1.43 trillion, a P/E ratio of 398.53, a price-to-earnings-growth ratio of 7.36 and a beta of 1.83. The company has a current ratio of 2.07, a quick ratio of 1.67 and a debt-to-equity ratio of 0.07.

Tesla (NASDAQ:TSLA - Get Free Report) last released its quarterly earnings results on Wednesday, January 28th. The electric vehicle producer reported $0.50 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.45 by $0.05. Tesla had a return on equity of 4.93% and a net margin of 4.00%.The business had revenue of $24.90 billion during the quarter, compared to analyst estimates of $24.75 billion. During the same quarter in the previous year, the company posted $0.73 earnings per share. Tesla's revenue for the quarter was down 3.1% on a year-over-year basis. On average, analysts predict that Tesla, Inc. will post 2.56 earnings per share for the current fiscal year.

Tesla Company Profile

Please first to comment

Related Post

Stay Connected

Tweets by elonmuskTo get the latest tweets please make sure you are logged in on X on this browser.

Energy

Energy